Semi Monthly Payroll

Understanding Semi-Monthly Payroll: A Comprehensive Guide

In the realm of Human Resources and payroll management, semi-monthly payroll stands out as a popular and efficient method for compensating employees. This comprehensive guide delves into the intricacies of semi-monthly payroll, exploring its definition, benefits, challenges, and implementation strategies. Whether you're an HR professional, a business owner, or an employee seeking to understand your pay schedule better, this article will provide valuable insights into this widely-used payroll system.

What is Semi-Monthly Payroll?

Semi-monthly payroll refers to a payment schedule where employees receive their wages twice a month, typically on fixed dates. This system differs from bi-weekly payroll, which pays employees every two weeks, resulting in 26 pay periods per year. In contrast, semi-monthly payroll has 24 pay periods annually.

Common payment dates for semi-monthly payroll include:

- The 1st and 15th of each month

- The 15th and last day of each month

- The 5th and 20th of each month

It's important to note that the exact dates may vary depending on company policies and local regulations, especially when payment dates fall on weekends or holidays.

Advantages of Semi-Monthly Payroll

Implementing a semi-monthly payroll system offers several benefits for both employers and employees:

1. Predictable Payment Schedule

One of the primary advantages of semi-monthly payroll is its consistency. Employees can reliably anticipate when they'll receive their paychecks, making it easier to plan their personal finances and budget effectively.

2. Simplified Accounting

For employers, semi-monthly payroll can streamline accounting processes. With 24 fixed pay periods per year, it's easier to calculate monthly deductions, taxes, and benefits. This consistency can lead to fewer errors and more efficient financial planning.

3. Alignment with Monthly Expenses

Many bills and financial obligations operate on a monthly cycle. Semi-monthly payroll aligns well with these cycles, helping employees manage their expenses more effectively. This can lead to improved financial wellbeing and reduced stress among the workforce.

4. Reduced Processing Time

Compared to weekly or bi-weekly payroll systems, semi-monthly payroll requires fewer processing cycles. This can save time and resources for the payroll department, allowing them to focus on other important HR tasks.

Challenges of Semi-Monthly Payroll

While semi-monthly payroll offers numerous benefits, it's not without its challenges:

1. Irregular Pay Periods

Unlike bi-weekly payroll, which consistently covers 80 hours per pay period for full-time employees, semi-monthly payroll can vary. Some months may have more workdays than others, leading to slight variations in pay amounts.

2. Overtime Calculations

Calculating overtime can be more complex with semi-monthly payroll, especially when pay periods split workweeks. HR professionals need to be vigilant in tracking hours worked and ensuring accurate overtime compensation.

3. Initial Implementation

Transitioning to a semi-monthly payroll system from another method can be challenging. It requires careful planning, clear communication with employees, and possibly updates to payroll software and processes.

4. Payroll Tax Considerations

Some payroll taxes are calculated on a quarterly basis, which doesn't align perfectly with semi-monthly pay periods. This can require additional attention to ensure accurate tax withholdings and reporting.

Implementing Semi-Monthly Payroll: Best Practices

For organizations considering a shift to semi-monthly payroll or looking to optimize their existing system, here are some best practices to consider:

1. Clear Communication

Transparancy is key when implementing or maintaining a semi-monthly payroll system. Ensure that all employees understand the payment schedule, how their pay is calculated, and any potential impacts on their finances.

2. Robust Timekeeping Systems

Accurate time tracking is crucial for semi-monthly payroll, especially for hourly employees. Invest in reliable timekeeping software that can handle the complexities of semi-monthly pay periods.

3. Regular Audits

Conduct regular audits of your payroll process to ensure accuracy and compliance with labor laws. This can help identify and rectify any issues before they become significant problems.

4. Flexible Payment Options

Consider offering flexible payment options, such as direct deposit or payroll cards, to make it easier for employees to access their earnings.

5. Training for Payroll Staff

Ensure that your payroll staff is well-trained in the nuances of semi-monthly payroll. This includes understanding how to handle overtime, bonuses, and other special pay situations.

Semi-Monthly Payroll vs. Other Payroll Frequencies

To fully appreciate the semi-monthly payroll system, it's helpful to compare it with other common payroll frequencies:

Weekly Payroll

Weekly payroll involves 52 pay periods per year. While it provides more frequent paychecks, it also requires more processing time and can be more expensive to administer.

Bi-Weekly Payroll

Bi-weekly payroll, with 26 pay periods per year, is another popular option. It offers a consistent 80-hour pay period for full-time employees but can lead to months with three paychecks, which some employees find challenging to budget for.

Monthly Payroll

Monthly payroll, with just 12 pay periods per year, is the least frequent option. While it's simple to administer, it can be difficult for employees to budget effectively over such long periods.

Compared to these options, semi-monthly payroll often strikes a balance between administrative efficiency and employee satisfaction.

Legal Considerations for Semi-Monthly Payroll

When implementing or maintaining a semi-monthly payroll system, it's crucial to be aware of legal considerations:

1. State Laws

Some states have specific requirements regarding pay frequency. For example, some states mandate that certain types of employees must be paid weekly. Always check your local labor laws to ensure compliance.

2. Fair Labor Standards Act (FLSA)

While the FLSA doesn't dictate pay frequency, it does require that overtime be paid on the regular payday for the period in which it was earned. This can be challenging with semi-monthly payroll if overtime spans two pay periods.

3. Timely Payment Laws

Many states have laws requiring employers to pay employees within a certain timeframe after the work is performed. Semi-monthly payroll must be structured to meet these requirements.

4. Record Keeping

Accurate record keeping is essential for any payroll system, including semi-monthly. Ensure your system can maintain detailed records of hours worked, wages paid, and deductions made.

Technology and Semi-Monthly Payroll

Advancements in technology have significantly impacted payroll processing, including semi-monthly systems:

1. Payroll Software

Modern payroll software can handle the complexities of semi-monthly payroll, including variable pay periods and overtime calculations. Many systems can also integrate with time tracking and accounting software for seamless processing.

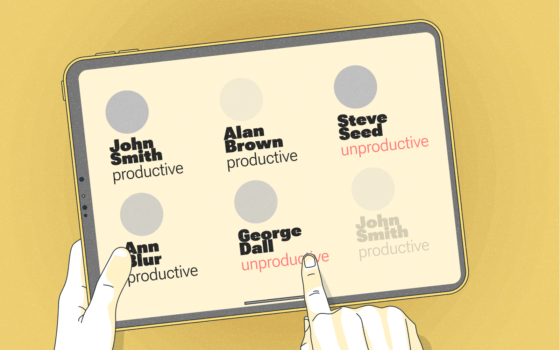

2. Employee Self-Service Portals

Self-service portals allow employees to access their pay stubs, tax forms, and other payroll-related information online. This can reduce the administrative burden on HR and payroll staff.

3. Mobile Apps

Some payroll systems offer mobile apps that allow employees to view their pay information, submit time off requests, and even clock in and out. This can be particularly useful for organizations with remote or field-based employees.

4. Artificial Intelligence and Machine Learning

Emerging technologies like AI and machine learning are being incorporated into payroll systems to improve accuracy, detect anomalies, and even predict payroll trends.

The Future of Semi-Monthly Payroll

As the workplace continues to evolve, so too will payroll systems. Here are some trends that may shape the future of semi-monthly payroll:

1. On-Demand Pay

Some companies are exploring on-demand pay options, allowing employees to access their earned wages before the scheduled payday. This could potentially complement or even replace traditional semi-monthly payroll for some organizations.

2. Blockchain Technology

Blockchain has the potential to revolutionize payroll processing by providing secure, transparent, and efficient payment systems. This could be particularly beneficial for companies with international employees.

3. Increased Automation

As payroll systems become more sophisticated, we can expect to see increased automation in areas like tax calculations, compliance checks, and report generation.

4. Gig Economy Adaptations

With the rise of the gig economy, payroll systems may need to adapt to handle more frequent, variable payments. This could lead to hybrid systems that combine elements of semi-monthly payroll with more flexible payment options.

Conclusion

Semi-monthly payroll remains a popular and effective method for compensating employees. Its balance of consistency for employees and efficiency for employers makes it a viable option for many organizations. However, like any payroll system, it requires careful implementation, ongoing management, and a thorough understanding of legal and practical considerations.

As we look to the future, semi-monthly payroll is likely to evolve alongside technological advancements and changing workforce dynamics. By staying informed about these trends and continually evaluating their payroll practices, organizations can ensure they're using the most effective and efficient payroll system for their unique needs.

Whether you're considering implementing a semi-monthly payroll system or looking to optimize your existing processes, remember that the key to success lies in clear communication, accurate record-keeping, and a commitment to compliance. With these elements in place, semi-monthly payroll can be a powerful tool for managing your organization's most valuable asset – its people.