Payroll Software

Understanding Payroll Software: A Comprehensive Guide

In the ever-evolving landscape of human resources management, payroll software has emerged as a crucial tool for businesses of all sizes. This powerful technology streamlines the complex process of managing employee compensation, ensuring accuracy, compliance, and efficiency. In this comprehensive guide, we'll delve into the intricacies of payroll software, exploring its features, benefits, and impact on modern HR practices.

What is Payroll Software?

Payroll software is a specialized computer program designed to automate and simplify the process of calculating and distributing employee wages. It handles a wide range of tasks, from tracking work hours and calculating deductions to generating pay stubs and managing tax withholdings. This technology has revolutionized the way businesses handle their payroll operations, reducing errors, saving time, and ensuring compliance with ever-changing tax laws and regulations.

Key Features of Payroll Software

Modern payroll software comes packed with a variety of features designed to streamline payroll processes and enhance overall efficiency. Let's explore some of the most common and valuable functionalities:

1. Automated Calculations

One of the primary functions of payroll software is to automate complex calculations. This includes computing gross wages, taxes, deductions, and net pay for each employee. The software takes into account various factors such as hourly rates, overtime, bonuses, and commissions to ensure accurate payroll processing.

2. Time and Attendance Tracking

Many payroll systems integrate time and attendance tracking features, allowing employees to clock in and out electronically. This data is then seamlessly incorporated into the payroll calculations, eliminating the need for manual data entry and reducing the risk of errors.

3. Tax Management

Payroll software helps businesses stay compliant with tax regulations by automatically calculating and withholding the appropriate amount of taxes from each employee's paycheck. It also generates and files necessary tax forms, such as W-2s and 1099s, saving HR professionals valuable time and reducing the risk of costly mistakes.

4. Direct Deposit

Most modern payroll systems offer direct deposit functionality, allowing employers to electronically transfer wages directly into employees' bank accounts. This feature not only saves time and resources but also provides convenience and security for both employers and employees.

5. Reporting and Analytics

Robust reporting capabilities are a hallmark of quality payroll software. These systems can generate a wide range of reports, including payroll summaries, tax liabilities, and labor cost analysis. Advanced analytics tools help businesses gain valuable insights into their payroll data, enabling informed decision-making and strategic planning.

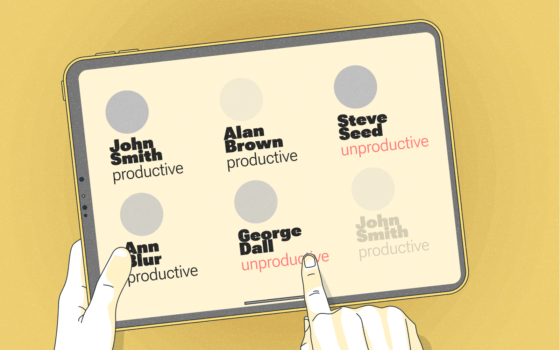

6. Employee Self-Service Portals

Many payroll software solutions include self-service portals that allow employees to access their pay stubs, tax forms, and personal information online. This feature empowers employees to manage their own data while reducing the administrative burden on HR staff.

Benefits of Implementing Payroll Software

The adoption of payroll software offers numerous advantages for businesses across industries. Let's explore some of the key benefits:

1. Increased Accuracy

By automating calculations and reducing manual data entry, payroll software significantly minimizes the risk of errors. This not only ensures that employees are paid correctly but also helps prevent costly mistakes that could lead to legal issues or financial penalties.

2. Time and Cost Savings

Automating payroll processes can dramatically reduce the time and resources required to manage employee compensation. This allows HR professionals to focus on more strategic initiatives and value-added tasks, ultimately improving overall organizational efficiency.

3. Improved Compliance

Staying compliant with ever-changing tax laws and regulations can be challenging for businesses. Payroll software helps ensure compliance by automatically updating tax rates and rules, generating required forms, and maintaining accurate records for auditing purposes.

4. Enhanced Security

Modern payroll software employs advanced security measures to protect sensitive employee data. This includes encryption, secure data storage, and role-based access controls, which help safeguard confidential information from unauthorized access or data breaches.

5. Scalability

As businesses grow and evolve, their payroll needs often become more complex. Payroll software can easily scale to accommodate changing requirements, whether it's adding new employees, managing multiple locations, or adapting to new tax jurisdictions.

Choosing the Right Payroll Software

Selecting the appropriate payroll software for your organization is a crucial decision that can have long-lasting impacts on your HR operations. Here are some factors to consider when evaluating different options:

1. Company Size and Complexity

Consider the size of your workforce and the complexity of your payroll needs. Some solutions are better suited for small businesses, while others are designed to handle the intricate requirements of large enterprises with multiple locations and diverse employee types.

2. Integration Capabilities

Look for payroll software that can integrate seamlessly with your existing HR and accounting systems. This ensures smooth data flow between different departments and eliminates the need for manual data transfer.

3. User-Friendliness

The software should be intuitive and easy to use, even for those without extensive technical expertise. A user-friendly interface can significantly reduce the learning curve and improve adoption rates among your staff.

4. Customization Options

Every business has unique payroll requirements. Choose a solution that offers flexibility and customization options to tailor the software to your specific needs.

5. Customer Support

Reliable customer support is essential when implementing and maintaining payroll software. Look for providers that offer comprehensive support services, including training, troubleshooting, and ongoing assistance.

6. Cost

Consider the total cost of ownership, including initial implementation fees, ongoing subscription costs, and any additional charges for support or upgrades. Evaluate the return on investment (ROI) to ensure the software aligns with your budget and provides value for your organization.

Implementation and Best Practices

Successfully implementing payroll software requires careful planning and execution. Here are some best practices to ensure a smooth transition:

1. Data Migration

Carefully plan the migration of existing payroll data to the new system. Ensure that all employee information, tax data, and historical records are accurately transferred to maintain continuity and compliance.

2. Training and Education

Provide comprehensive training to all staff members who will be using the new payroll software. This includes HR personnel, managers, and employees who will access self-service portals. Proper training ensures that the software is used effectively and reduces the risk of errors.

3. Testing and Validation

Before fully transitioning to the new system, conduct thorough testing to ensure all calculations are accurate and all features are functioning correctly. Run parallel payrolls with your old and new systems to validate results before going live.

4. Establish Clear Processes

Develop and document clear processes for using the new payroll software. This includes procedures for data entry, approval workflows, and handling exceptions or errors.

5. Regular Audits and Updates

Conduct regular audits of your payroll processes to ensure ongoing accuracy and compliance. Stay informed about software updates and new features to maximize the value of your investment.

The Future of Payroll Software

As technology continues to advance, the future of payroll software looks increasingly sophisticated and integrated. Here are some trends shaping the evolution of payroll technology:

1. Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being incorporated into payroll software to enhance predictive analytics, automate complex decision-making processes, and improve overall accuracy.

2. Cloud-Based Solutions

The shift towards cloud-based payroll software is accelerating, offering greater flexibility, scalability, and accessibility for businesses of all sizes.

3. Mobile Optimization

With the increasing prevalence of remote work, mobile-optimized payroll solutions are becoming essential, allowing employees and managers to access payroll information and perform tasks on-the-go.

4. Blockchain Technology

Blockchain has the potential to revolutionize payroll processing by enhancing security, transparency, and efficiency in wage distribution and record-keeping.

5. Enhanced Integration

Future payroll software will likely offer even deeper integration with other HR and business systems, creating a more holistic and seamless approach to workforce management.

Conclusion

Payroll software has become an indispensable tool for modern businesses, offering a wide range of benefits from increased accuracy and efficiency to improved compliance and employee satisfaction. As technology continues to evolve, payroll software will play an increasingly crucial role in shaping the future of HR management.

By carefully selecting and implementing the right payroll solution, organizations can streamline their payroll processes, reduce costs, and free up valuable resources to focus on strategic initiatives. As we look to the future, the continued advancement of payroll technology promises even greater opportunities for businesses to optimize their workforce management and drive overall success.

In an era where efficiency and accuracy are paramount, investing in robust payroll software is not just a luxury – it's a necessity for businesses aiming to stay competitive and compliant in today's dynamic business landscape.