Monthly Payroll

Understanding Monthly Payroll: A Comprehensive HR Glossary

Monthly payroll is a critical component of human resources management, ensuring employees receive their compensation accurately and on time. This comprehensive glossary delves into the intricacies of monthly payroll, providing HR professionals and business owners with valuable insights into this essential process.

The Basics of Monthly Payroll

Monthly payroll refers to the process of calculating and distributing employee salaries on a monthly basis. This system is widely used across various industries and offers several advantages for both employers and employees. Let's explore the fundamental concepts and terminolgy associated with monthly payroll.

Gross Pay

Gross pay is the total amount of money an employee earns before any deductions are made. It includes the base salary, overtime pay, bonuses, and other forms of compensation. For salaried employees, gross pay is typically a fixed amount each month, while for hourly workers, it may vary based on the number of hours worked.

Net Pay

Net pay, also known as take-home pay, is the amount an employee receives after all deductions have been made from their gross pay. These deductions may include taxes, insurance premiums, retirement contributions, and other withholdings. Net pay is the actual amount that appears on an employee's paycheck or is deposited into their bank account.

Payroll Cycle

The payroll cycle refers to the frequency with which employees are paid. In a monthly payroll system, employees receive their salaries once per month, typically on a specific date (e.g., the 1st or the last day of the month). This cycle impacts various aspects of payroll processing, including tax calculations and reporting requirements.

Key Components of Monthly Payroll Processing

Processing monthly payroll involves several crucial steps and considerations. Understanding these components is essential for HR professionals to ensure accurate and compliant payroll management.

Time and Attendance Tracking

Accurate time and attendance tracking is fundamental to monthly payroll processing. For hourly employees, this involves recording the number of hours worked, including regular hours, overtime, and any paid time off. Even for salaried employees, tracking attendance is important for managing leave balances and ensuring compliance with company policies.

Salary Calculations

Calculating salaries for monthly payroll requires careful consideration of various factors. For salaried employees, this may be straightforward, involving a fixed monthly amount. However, for hourly workers, calculations must account for regular hours, overtime, shift differentials, and any other applicable pay rates.

Deductions and Withholdings

Monthly payroll processing involves managing various deductions and withholdings. These may include:

- Income tax withholdings (federal, state, and local)

- Social Security and Medicare contributions

- Health insurance premiums

- Retirement plan contributions

- Garnishments or wage attachments

HR professionals must ensure that all deductions are calculated correctly and in compliance with relevant laws and regulations.

Payroll Taxes

Managing payroll taxes is a critical aspect of monthly payroll processing. This includes calculating and withholding employee taxes, as well as determining the employer's tax obligations. Payroll taxes typically encompass:

- Federal Insurance Contributions Act (FICA) taxes

- Federal Unemployment Tax Act (FUTA) taxes

- State unemployment insurance taxes

- Any applicable local taxes

Staying up-to-date with tax laws and regulations is crucial for accurate payroll tax management.

Benefits and Challenges of Monthly Payroll

Implementing a monthly payroll system offers several advantages but also comes with its own set of challenges. Understanding these can help organizations make informed decisions about their payroll processes.

Advantages of Monthly Payroll

- Reduced administrative workload: Processing payroll once a month instead of bi-weekly or weekly can significantly reduce the time and resources required for payroll administration.

- Improved cash flow management: Monthly payroll allows for better budgeting and cash flow planning for both employers and employees.

- Simplified accounting: With fewer payroll runs, reconciliation and financial reporting become more straightforward.

- Cost savings: Reduced processing frequency can lead to lower administrative costs and bank fees.

Challenges of Monthly Payroll

- Longer pay periods: Employees may find it challenging to budget for a full month, especially if they're accustomed to more frequent pay cycles.

- Increased complexity in calculations: Monthly payroll may require more complex calculations, particularly for hourly employees or those with variable compensation.

- Potential for errors: With a larger amount of data to process in each payroll run, there's an increased risk of errors if proper checks and balances are not in place.

- Compliance considerations: Some jurisdictions have specific requirements or limitations regarding monthly pay frequencies, which must be carefully navigated.

Technology and Monthly Payroll

Advancements in technology have revolutionized monthly payroll processing, offering enhanced efficiency, accuracy, and compliance. Let's explore some key technological aspects of modern payroll systems.

Payroll Software

Payroll software has become an indispensable tool for managing monthly payroll. These systems automate many aspects of payroll processing, including:

- Salary calculations

- Tax withholdings

- Deduction management

- Reporting and analytics

Advanced payroll software often integrates with other HR systems, such as time and attendance tracking and benefits administration, to streamline the entire payroll process.

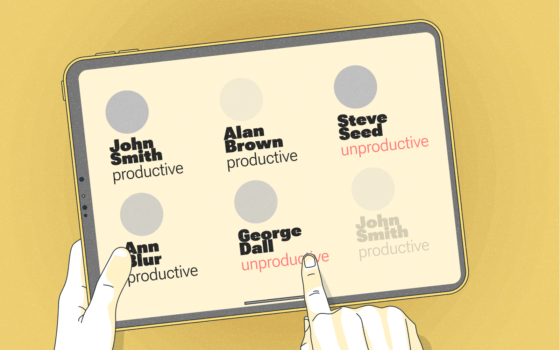

Employee Self-Service Portals

Many modern payroll systems include employee self-service portals, which allow employees to access their payroll information, view pay stubs, update personal information, and manage certain aspects of their benefits. These portals enhance transparency and reduce the administrative burden on HR departments.

Direct Deposit and Electronic Payments

Electronic payment methods, particularly direct deposit, have become the norm for monthly payroll disbursements. These methods offer several advantages:

- Increased security

- Faster payment processing

- Reduced costs associated with paper checks

- Improved record-keeping and traceability

Some organizations also offer alternative payment methods, such as payroll cards, to accommodate employees without traditional bank accounts.

Compliance and Reporting in Monthly Payroll

Ensuring compliance with labor laws, tax regulations, and reporting requirements is a critical aspect of monthly payroll management. HR professionals must stay informed about various compliance issues and implement robust reporting processes.

Regulatory Compliance

Monthly payroll must adhere to numerous regulations, including:

- Fair Labor Standards Act (FLSA)

- State labor laws

- Internal Revenue Service (IRS) regulations

- Equal Pay Act

Compliance involves accurate classification of employees, proper overtime calculations, adherence to minimum wage laws, and correct tax withholdings, among other considerations.

Payroll Reporting

Regular payroll reporting is essential for both internal management and external compliance. Key reports in monthly payroll may include:

- Payroll registers

- Tax liability reports

- Labor distribution reports

- Deduction reports

These reports provide valuable insights into payroll costs, help identify discrepancies, and support financial planning and budgeting processes.

Year-End Processes

Monthly payroll systems must also accommodate year-end processes, including:

- Generating W-2 forms for employees

- Preparing and filing annual tax returns

- Reconciling payroll accounts

- Processing any necessary adjustments or corrections

Proper planning and execution of year-end processes are crucial for maintaining compliance and starting the new year on a solid footing.

Best Practices for Managing Monthly Payroll

Implementing effective strategies and best practices can help organizations optimize their monthly payroll processes, ensuring accuracy, efficiency, and compliance.

Establish Clear Policies and Procedures

Developing comprehensive payroll policies and procedures is essential for consistent and accurate payroll processing. These should cover areas such as:

- Pay periods and paydates

- Time and attendance tracking

- Overtime calculations

- Leave management

- Payroll deductions

Clear documentation of these policies helps ensure that all stakeholders understand the payroll process and their responsibilities.

Implement Robust Data Management Practices

Accurate and secure data management is crucial for effective monthly payroll processing. Best practices include:

- Regularly updating employee information

- Implementing data validation checks

- Ensuring proper data backup and recovery procedures

- Maintaining data confidentiality and security

Effective data management minimizes errors and protects sensitive employee information.

Conduct Regular Audits

Periodic payroll audits help identify discrepancies, ensure compliance, and improve overall payroll accuracy. Audits may involve:

- Reviewing payroll calculations

- Verifying tax withholdings and deductions

- Checking for proper employee classifications

- Ensuring compliance with labor laws and regulations

Regular audits can help catch and correct errors before they become significant issues.

Provide Ongoing Training and Education

Keeping payroll staff up-to-date with the latest regulations, best practices, and technology is crucial for maintaining an effective monthly payroll system. This may involve:

- Attending industry conferences and seminars

- Participating in webinars and online courses

- Subscribing to relevant publications and newsletters

- Conducting internal training sessions

Ongoing education ensures that payroll professionals can adapt to changing regulations and implement best practices effectively.

Future Trends in Monthly Payroll

As technology continues to evolve and workplace dynamics shift, monthly payroll processes are likely to see significant changes in the coming years. Understanding these trends can help organizations prepare for the future of payroll management.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are increasingly being integrated into payroll systems, offering benefits such as:

- Improved accuracy in payroll calculations

- Predictive analytics for budgeting and forecasting

- Automated anomaly detection and fraud prevention

- Enhanced personalization of employee payroll experiences

These technologies have the potential to significantly streamline monthly payroll processes and reduce errors.

Blockchain Technology

Blockchain technology could revolutionize payroll processing by offering:

- Enhanced security and transparency in payroll transactions

- Improved cross-border payment processes

- Simplified compliance and auditing procedures

- Real-time payroll processing capabilities

While still in its early stages, blockchain has the potential to address many challenges associated with traditional payroll systems.

Gig Economy and Flexible Pay Options

The rise of the gig economy and changing employee expectations are driving demand for more flexible payroll options, such as:

- On-demand pay or earned wage access

- Multiple payment frequencies within a single payroll system

- Integration of contractor and freelancer payments

- Customizable pay schedules to meet individual employee needs

Monthly payroll systems will need to adapt to accommodate these evolving workforce trends.

Conclusion

Monthly payroll is a complex and critical function within human resources management. From understanding basic concepts like gross and net pay to navigating compliance requirements and leveraging advanced technologies, effective monthly payroll management requires a comprehensive approach.

By implementing best practices, staying informed about regulatory changes, and embracing emerging technologies, organizations can optimize their monthly payroll processes to ensure accuracy, efficiency, and employee satisfaction. As the workplace continues to evolve, so too will the strategies and tools used to manage monthly payroll, making it an exciting and dynamic area of HR management.

Whether you're an HR professional, a business owner, or simply interested in understanding the intricacies of payroll management, this glossary provides a solid foundation for navigating the world of monthly payroll. By mastering these concepts and staying attuned to industry trends, you'll be well-equipped to handle the challenges and opportunities that come with managing monthly payroll in today's dynamic business environment.