What Is Job Costing?

Job costing is an accounting method used to track and allocate costs to specific projects or jobs. It's crucial for businesses that provide unique products or services, helping them accurately price jobs, manage resources, and evaluate profitability. Key components include direct materials, direct labor, and overhead costs.

In the ever-evolving landscape of business accounting, job costing stands out as a critical tool for companies that deal with custom orders or unique projects. This comprehensive guide will delve into the intricacies of job costing, its applications, and its significance in modern business practices.

Understanding Job Costing

Job costing, also known as project costing, is an accounting method used to track and allocate costs to specific jobs or projects. This approach is particularly valuable for businesses that provide customized products or services, as it allows for precise tracking of expenses associated with each unique job.

Key Components of Job Costing

The job costing process typically involves three main cost categories:

- Direct Materials: Raw materials directly used in the production of a specific job.

- Direct Labor: Wages and benefits for employees directly working on the job.

- Overhead Costs: Indirect expenses that cannot be directly attributed to a specific job but are necessary for overall operations.

Understanding these components is crucial for accurate cost allocation and pricing strategies.

The Job Costing Process

The job costing process involves several steps, from initial job identification to final cost analysis. Here's a breakdown of the typical workflow:

| Step | Description |

| 1. Job Identification | Assign a unique identifier to each job or project |

| 2. Cost Estimation | Estimate the expected costs for materials, labor, and overhead |

| 3. Cost Accumulation | Track and record actual costs as they occur |

| 4. Cost Allocation | Assign indirect costs to specific jobs based on predetermined rates |

| 5. Job Completion | Finalize all costs associated with the completed job |

| 6. Analysis | Compare actual costs to estimated costs and evaluate profitability |

Benefits of Job Costing

Implementing a job costing system offers numerous advantages for businesses:

- Accurate Pricing: Enables precise cost calculations, leading to more competitive and profitable pricing strategies.

- Improved Profitability Analysis: Allows for detailed evaluation of each job's profitability.

- Enhanced Resource Management: Helps identify areas of inefficiency and optimize resource allocation.

- Better Decision Making: Provides valuable data for informed business decisions and future job estimates.

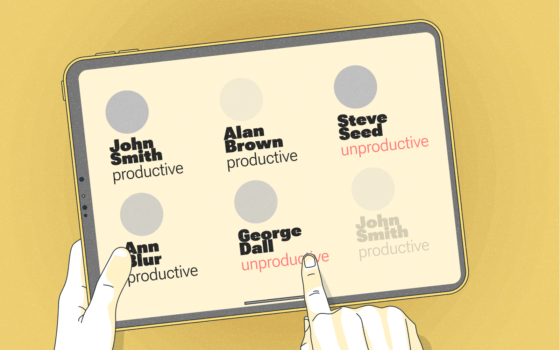

- Increased Accountability: Facilitates tracking of individual and departmental performance.

Job Costing vs. Process Costing

While job costing is ideal for unique projects, process costing is more suitable for businesses that produce large quantities of identical products. Here's a comparison:

| Aspect | Job Costing | Process Costing |

| Product Type | Unique, customized | Homogeneous, mass-produced |

| Cost Accumulation | By individual job | By production department or process |

| Cost Flow | Job Cost Sheet | Production Cost Report |

| Industries | Construction, consulting, custom manufacturing | Food processing, chemical manufacturing, oil refining |

Implementing Job Costing: Best Practices

To maximize the benefits of job costing, consider these best practices:

- Utilize Job Costing Software: Invest in specialized software to streamline the process and improve accuracy.

- Train Employees: Ensure all relevant staff understand the importance of accurate time and material tracking.

- Regularly Review Overhead Rates: Periodically reassess and adjust overhead allocation rates to maintain accuracy.

- Implement Real-Time Tracking: Use technology to capture costs as they occur, reducing errors and delays.

- Conduct Post-Job Reviews: Analyze completed jobs to identify areas for improvement and refine future estimates.

Job Costing in the Digital Age

The advent of advanced technologies has significantly impacted job costing practices. In 2024, we're seeing a surge in the adoption of AI-driven job costing systems that can predict costs with unprecedented accuracy. According to a recent study by the American Institute of Certified Public Accountants (AICPA), 78% of surveyed companies reported improved profitability after implementing AI-enhanced job costing tools.

Did you know? The global job costing software market is expected to reach $3.2 billion by 2028, growing at a CAGR of 7.5% from 2023 to 2028. (Source: MarketsandMarkets Research)

Job Costing Challenges and Solutions

While job costing offers numerous benefits, it's not without its challenges. Here are some common issues and potential solutions:

| Challenge | Solution |

| Inaccurate Time Tracking | Implement automated time tracking systems |

| Overhead Allocation Errors | Regularly review and adjust allocation methods |

| Scope Creep | Establish clear project boundaries and change order processes |

| Data Silos | Use integrated software solutions to centralize data |

| Estimating Errors | Develop a historical database of job costs for reference |

Job Costing Across Industries

While job costing is commonly associated with manufacturing and construction, its applications extend across various industries. Here's how job costing is utilized in different sectors:

- Construction: Tracking costs for materials, labor, and equipment for each building project.

- Professional Services: Allocating time and resources to client engagements in consulting or legal firms.

- Healthcare: Calculating costs for specific medical procedures or patient treatments.

- Film Production: Managing budgets for individual movies or TV shows.

- Software Development: Tracking costs for custom software projects or app development.

Each industry may have unique considerations when implementing job costing systems. For instance, the film industry often deals with highly variable costs and tight schedules, requiring more flexible job costing approaches.

The Future of Job Costing

As we look towards the future, several trends are shaping the evolution of job costing:

- Integration with IoT: The Internet of Things (IoT) is enabling real-time tracking of materials and equipment, enhancing the accuracy of job costing.

- Predictive Analytics: Advanced algorithms are being used to forecast job costs based on historical data and market trends.

- Blockchain Technology: Some companies are exploring blockchain for transparent and immutable cost tracking across complex supply chains.

- Sustainability Metrics: There's a growing emphasis on incorporating environmental costs into job costing calculations.

Emerging Trend: Green Job Costing In response to increasing environmental concerns, some companies are now incorporating "green job costing" practices. This involves factoring in environmental costs and benefits when calculating the total cost of a job, including carbon footprint, waste reduction, and energy efficiency.

Financial Implications of Job Costing

The financial impact of effective job costing can be significant. Let's break down some numbers:

| Metric | Average Improvement |

| Project Profitability | 10-20% increase |

| Cost Overruns | 15-25% reduction |

| Bidding Accuracy | 30-40% improvement |

| Resource Utilization | 20-30% increase |

These improvements can translate into substantial financial gains. For instance, a construction company with annual revenue of CAD 50 million (approximately USD 37 million) could potentially see an increase in profits of CAD 5-10 million (USD 3.7-7.4 million) through improved job costing practices.

Common Pitfalls in Job Costing

While job costing can be highly beneficial, there are several common mistakes that businesses should avoid:

- Overlooking Indirect Costs: Failing to account for all overhead costs can lead to underpricing.

- Inconsistent Application: Applying job costing methods inconsistently across projects can skew comparisons.

- Neglecting Technology: Relying on outdated or manual systems can result in errors and inefficiencies.

- Ignoring Historical Data: Failing to learn from past projects can lead to repeated estimation errors.

- Lack of Employee Buy-in: Not properly training or motivating employees to participate in job costing can compromise data accuracy.

Job Costing and Pricing Strategies

Accurate job costing is fundamental to developing effective pricing strategies. Here are some pricing approaches that rely heavily on job costing data:

- Cost-Plus Pricing: Adding a predetermined profit margin to the total job cost.

- Value-Based Pricing: Setting prices based on the perceived value to the customer, informed by accurate cost data.

- Target Costing: Working backwards from a target price to determine acceptable costs.

- Dynamic Pricing: Adjusting prices in real-time based on current costs and market conditions.

Each of these strategies requires precise job costing to be effective. For example, cost-plus pricing without accurate job costing could lead to pricing that's either uncompetitive or unprofitable.

Regulatory Considerations in Job Costing

Job costing practices are subject to various regulatory considerations, particularly in industries like government contracting or publicly funded projects. Key regulations to be aware of include:

- Generally Accepted Accounting Principles (GAAP): In the United States, job costing methods must comply with GAAP standards.

- International Financial Reporting Standards (IFRS): For global operations, IFRS guidelines may apply to job costing practices.

- Cost Accounting Standards (CAS): In government contracting, CAS regulations dictate specific job costing requirements.

Compliance with these regulations is crucial to avoid legal issues and maintain the integrity of financial reporting.

Conclusion

Job costing remains a critical tool for businesses dealing with unique projects or custom orders. Its ability to provide detailed cost insights, improve pricing accuracy, and enhance profitability makes it indispensable in today's competitive business environment. As technology continues to evolve, job costing practices are becoming more sophisticated, offering even greater benefits to those who implement them effectively.

Whether you're in construction, manufacturing, professional services, or any industry that deals with project-based work, mastering job costing can be a game-changer for your business. By understanding its principles, leveraging technology, and avoiding common pitfalls, you can turn job costing into a powerful tool for driving profitability and success.

Remember: Job costing is not just about tracking costs; it's about gaining insights that drive better business decisions. Embrace it as a strategic tool, and watch your project management and profitability soar.