Timesheets for Payroll

Timesheets for payroll or payroll timesheets are an essential tool for businesses to accurately track employee hours and calculate payroll. They provide a transparent record of time worked, helping businesses ensure compliance with labor laws, prevent fraud, and maintain accurate payroll records.

Among workers who diligently track their time, only 66% in the United States and 54% in Canada are compensated based on hourly wages. The remaining individuals fall into categories such as salaried employees, self-employed individuals, or business owners.

In this article, we will explore the benefits of using employee timesheets, the different types of timesheets available, best practices for creating effective timesheets, and challenges that may arise, along with solutions to overcome them.

Timesheets for Payroll: Things To Include

Timesheets are documents used by employers to track and record the number of hours worked by employees in a given pay period. These timesheets are typically used to calculate the wages and salaries owed to employees based on their hourly rates or agreed-upon salaries.

Further, payroll- timesheets provide a detailed account of how many hours of time employees spend on various tasks, projects, or shifts, and are essential for ensuring accurate and timely payroll processing.

Timesheets typically include the following information:

(i). Employee Information: Timesheets typically require employees to provide their name, employee ID, and department or job title.

(ii). Date and Time: Employees record the start and end times of their work shifts, as well as any breaks or time off taken during the work period. This information is crucial for calculating the total number of hours they worked.

(iii). Task or Project Information: Timesheets may require employees to specify the tasks or projects they worked on during their shift, along with any relevant codes or descriptions. This helps employers allocate labor costs to specific tasks or projects for accurate costing and budgeting.

(iv). Overtime or Special Pay: If employees work beyond their regular hours or are entitled to billable hours or special pay, such as holiday pay or shift differentials, this information may be recorded on the timesheet.

(v). Employee Signature: Employees may be required to sign their timesheets to confirm the accuracy of the recorded number of hours worked.

You might already know that payroll timesheets are typically submitted to a designated person, such as a supervisor or a payroll administrator, for verification and processing. They serve as important documentation for ensuring that employees are paid accurately and in compliance with labor laws and company policies.

Major Benefits of Timesheets

Did you know that 47% of business owners age 50 or older still prefer that their employees use paper timesheets for time tracking? The same timesheet template for payroll as discussed above has the following benefits for small and large:

1. Compliance with Labor Laws

Timesheets are crucial for accurately tracking the number of hours worked by employees. They provide a clear record of when employees start and end their shifts, including breaks and overtime. This information is essential for tracking time, calculating wages, and ensuring that employees are paid fairly and accurately for their work.

With accurate timesheets, businesses can avoid underpayment or overpayment of wages, which can result in legal and financial consequences.

2. Transparency and Accountability

Timesheets promote transparency and accountability in the workplace. They provide a clear and verifiable record of the time employees spend on different tasks or projects. This helps managers and supervisors monitor employee productivity, identify areas for improvement, and recognize top performers. Employees also benefit from the transparency of timesheets as they can review and verify their number of hours worked, reducing disputes or misunderstandings about their pay.

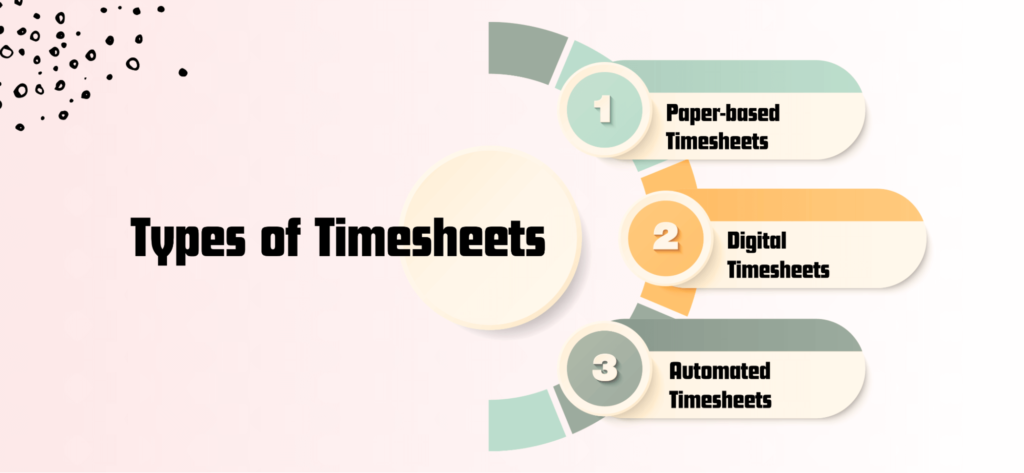

Types of Timesheets

There are several types of timesheets available, including paper-based, digital, and automated online timesheets.

(i). Paper-based Timesheets

Paper-based timesheets are physical forms that employees fill out manually to record their hours worked. They are simple and inexpensive to implement but can be time-consuming and prone to errors. Employees must remember to carry and submit the paper timesheets, and there is a risk of loss or damage. Moreover, paper-based timesheets can be easily manipulated or falsified, leading to inaccurate and unreliable records.

(ii). Digital Timesheets

Digital timesheets are electronic forms that employees fill out online or through software applications. They offer the advantage of being accessible from anywhere, eliminating the need for physical submission. Digital timesheets can be designed with validation rules to minimize errors, and they can be easily backed up and secured for record-keeping purposes. However, they may require additional hardware or software investments, and employees must be trained to use them effectively.

(iii). Automated Timesheets

Automated timesheets are integrated with time-tracking systems or clock-in/clock-out devices. They automatically make timesheet templates to capture and record employee hours, eliminating the need for manual input.

Automated timesheets can be linked with other systems such as payroll software, making the process seamless and efficient. They are highly accurate, as they eliminate human error and potential timesheet fraud. However, they may require significant investment in technology and may not be suitable for all types of businesses.

Get more out of your business

Get the best employee engagement content every week via mailing list

5 Proven Tips to Create Effective Timesheets

As discussed earlier in the article, timesheets are crucial tools for accurately tracking employee work hours and ensuring fair compensation. Thus, creating effective timesheets can streamline your payroll process and minimize errors. What do you think, there are some tips to help you out.

The following five proven tips will help you create effective timesheets and achieve your compensation objectives:

1. Use a Clear and Simple Format

You remember the 7 Cs of effective communication, right? Clarity is one of them and it plays a crucial role and comes at the top.

The format of your timesheets should be clear and easy to understand. Avoid cluttered layouts or complex designs that may confuse employees when recording their hours. A simple and organized format lets employees input their hours quickly and accurately.

Example: Use a table format with columns for date, start time, end time, and breaks. Provide clear instructions on how to fill in each field, such as “Enter time in HH: MM format” or “Round to the nearest quarter-hour.”

2. Include All Relevant Information

Ensure that your timesheets capture all relevant information needed for payroll processing. This includes employee name, job or project name, date, hours worked, breaks taken, and any other relevant data required for accurate payroll calculations.

Example: Include fields for specific tasks or projects, so employees can allocate their time accordingly. For instance, if an employee works on multiple projects, have separate columns or rows for each project, making it easy to track time spent on each project.

3. Set Clear Guidelines for Time Tracking

Establish clear guidelines for how employees should track their time, including start and end times, breaks, and rounding rules. This ensures consistency and accuracy in project management and time tracking across the organization.

Example: Specify that employees should record time in a 24-hour format, round up or down to the nearest 15-minute interval, and indicate breaks taken, if applicable.

4. Provide Easy Access and Submission

Make it convenient for employees to access and submit their timesheets. This can be through a web-based timesheet portal, mobile timesheet app, or physical copies. Avoid complicated submission processes that may discourage employees from submitting their timesheets on time.

Example: Provide a user-friendly online employee timesheet portal that allows employees to access and submit their timesheets from anywhere, at any time. Include reminders or notifications for submission deadlines to ensure timely submissions.

5. Regularly Review and Verify Timesheets

Regularly review and verify timesheets for accuracy and compliance with labor laws. Address any discrepancies or errors promptly to ensure correct payroll calculations and prevent potential legal issues.

Example: Have a designated person or team member responsible for reviewing and verifying timesheets. Cross-check the recorded hours against work schedules, attendance records, and other relevant data to ensure accuracy.

By following these proven tips, you can create effective timesheets that simplify time tracking for employees and streamline your payroll process, ensuring accurate and efficient payroll calculations.

Best Practices for Using Timesheets

Using timesheets effectively for payroll processing requires the following best practices to ensure accuracy and efficiency:

(i). Educating Employees on Timesheet Usage

It is important to educate employees on how to properly use timesheets to record their hours worked. This includes providing clear instructions on how to fill out timesheets, what information needs to be recorded weekly timesheets used, and the consequences of inaccurate or fraudulent timesheet entries. Regular training and reminders can help employees understand the importance of accurate timesheet usage and prevent errors.

(ii). Regular Review and Approval Process

Implementing a review and approval process for timesheets can help identify and rectify any errors or discrepancies before processing payroll. Managers or supervisors should review and verify timesheets for accuracy and compliance with labor laws. This can include cross-checking timesheet entries with other records, such as schedules or attendance logs, to ensure consistency and accuracy.

(iii). Integration with Payroll Software

Integrating timesheets with payroll software can streamline the payroll process and minimize manual data entry errors. Timesheets should be easily exportable or directly linked with payroll software, allowing for seamless transfer of data for payroll calculations. This can save time and effort in processing payroll, while also ensuring accuracy and consistency in wage calculations.

Challenges and Solutions

Based on statistical data, it is evident that time theft is widespread in the United States, as individuals engage in non-work-related activities for approximately 54 minutes per day during work hours. This behavior leads to substantial payroll losses, with as much as 10% of payments being disbursed for the time that is not dedicated to work-related tasks.

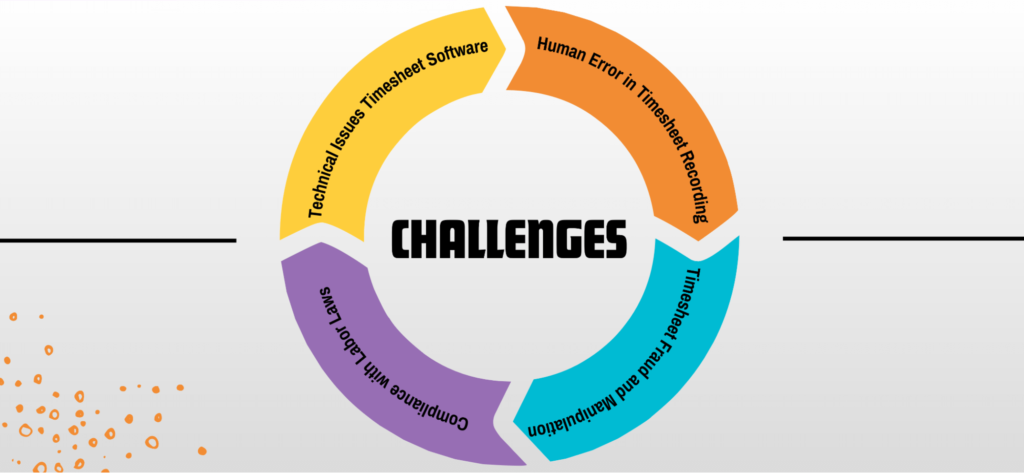

Despite the benefits and best practices, challenges may arise in using payroll timesheets. Here are some common challenges and their potential solutions:

(i). Human Error in Timesheet Recording

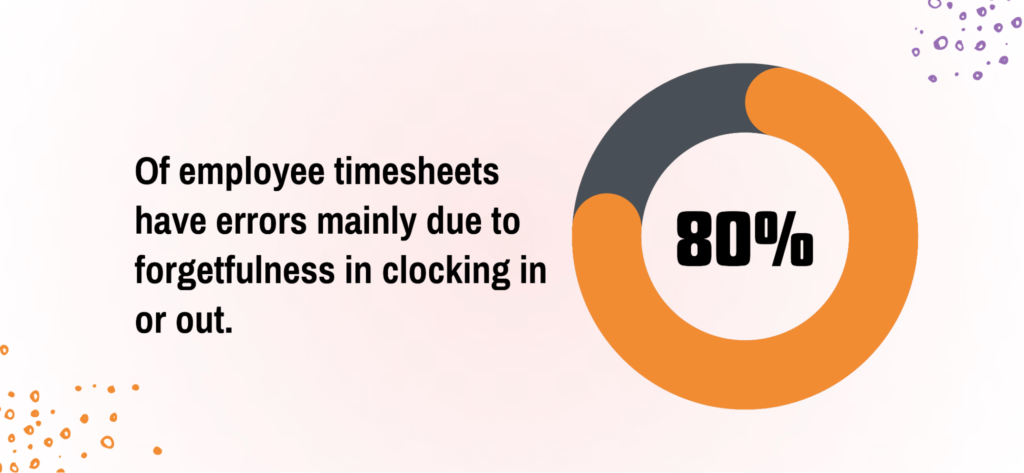

As reported by Intuit Quickbooks, a significant 80% of the timesheets submitted by their employees contain errors that require correction. When probed, employees cited the inability to recall their hours due to forgetfulness in clocking in or out as the primary reason for these errors.

Employees may make mistakes when recording their total hours on timesheets, such as incorrect time entries or forgetting to record breaks. To address this, it is important to provide thorough training on timesheet usage and regularly remind employees to double-check their entries for accuracy. Timesheets should also have validation rules in place to catch common errors, and employees should be encouraged to report any discrepancies they notice.

(ii). Timesheet Fraud and Manipulation

In 2007, HR Magazine conducted a study that unveiled that a majority of American employees, specifically 73%, had witnessed unethical behaviors occurring in their workplace. Further, over 60% of retail employees have confessed to engaging in the unethical practice of time theft, which provides insight into the staggering $177 billion hole in the US Commerce Department.

There may be instances where employees intentionally manipulate timesheets to record false hours or claim overtime that they did not work. This can result in inaccurate payroll calculations and financial losses for the business. To prevent timesheet fraud, it is important to implement strict controls, such as requiring employees to sign timesheets, cross-checking timesheet entries with other records, and conducting regular audits.

Automated timesheet systems with built-in security features, such as biometric verification or IP address and time tracking software, can also help prevent timesheet fraud.

(iii). Compliance with Labor Laws

Compliance with labor laws, such as overtime regulations, can be challenging when using timesheets. Employers must ensure that timesheets accurately capture all hours worked, including overtime hours, and calculate wages accordingly. This may require implementing additional controls, such as setting up automatic alerts for approaching overtime thresholds or conducting regular audits to ensure compliance with labor laws.

(iv). Technical Issues with Timesheet Software

Technical issues with timesheet software, such as system crashes or data loss, can disrupt the payroll process and cause delays. To mitigate these risks, it is important to choose reliable online timesheet software and providers and regularly back up timesheet data. Having a contingency plan in place, such as a manual timesheet recording process as a backup, can also help minimize the impact of technical issues.

Conclusion

Timesheets are a crucial tool for accurate time tracking and seamless payroll processing. By following best practices, such as designing user-friendly layouts, capturing relevant information, implementing proper validation, educating employees, and integrating with payroll software, businesses can effectively use timesheets to streamline their payroll process and ensure accurate wage calculations.

Using timesheets, and client billing, however, comes with its challenges, such as human error, timesheet fraud, and compliance with labor laws. By implementing strict controls, conducting regular audits, and choosing reliable timesheet software providers, these challenges can be mitigated.

In conclusion, payroll timesheets are a valuable tool for businesses of all sizes to ensure accurate and efficient payroll processing. By considering best practices, addressing challenges, and continuously improving the process, small businesses can effectively use timesheets as part of their payroll management strategy.

FAQs

Like many others, you might also frequently ask these questions:

1. Are Timesheets Mandatory For Payroll Processing?

Timesheets are not mandatory for payroll processing, but they are highly recommended as they provide an accurate and reliable way to keep time theft, track employee hours, and calculate wages.

2. Can I Use Manual Timesheets Instead Of Automated Timesheet Software?

Yes, manual timesheets can be used for payroll processing, but they may be more prone to human error and may not be as efficient as automated timesheet software.

3. How Often Should I Review And Approve Timesheets?

Timesheets should be reviewed and approved regularly, preferably on a daily or weekly basis, to ensure accuracy and compliance with labor laws.

4. What Are Some Common Mistakes To Watch Out For When Using Timesheets?

Common mistakes to watch out for when using timesheets include incorrect time entries, missing information, and inaccurate calculations. Regular training and reminders can help employees avoid these mistakes.

5. Is It Necessary To Integrate Timesheets With Payroll Software?

Integrating timesheets with payroll software is not mandatory, but it can greatly streamline the payroll process and minimize manual data entry errors. It is recommended for businesses that process payroll frequently or have a large number of hourly employees either.