How to Pay Independent Contractors

Are you an employer who hires independent contractors? Are you looking for a step-by-step guide on how to pay them? If so, you’ve come to the right place! This blog post will provide you with a step-by-step guide on how to pay your independent contractors using a method known as the “1099 payroll.”

This payroll is a system that allows employers to withhold taxes and other deductions from an employee’s paycheck. Here, with us at Monitask, we’ll walk you through the entire process, from start to finish, so that you can be confident in your ability to compensate your contractors adequately. Let’s get started!

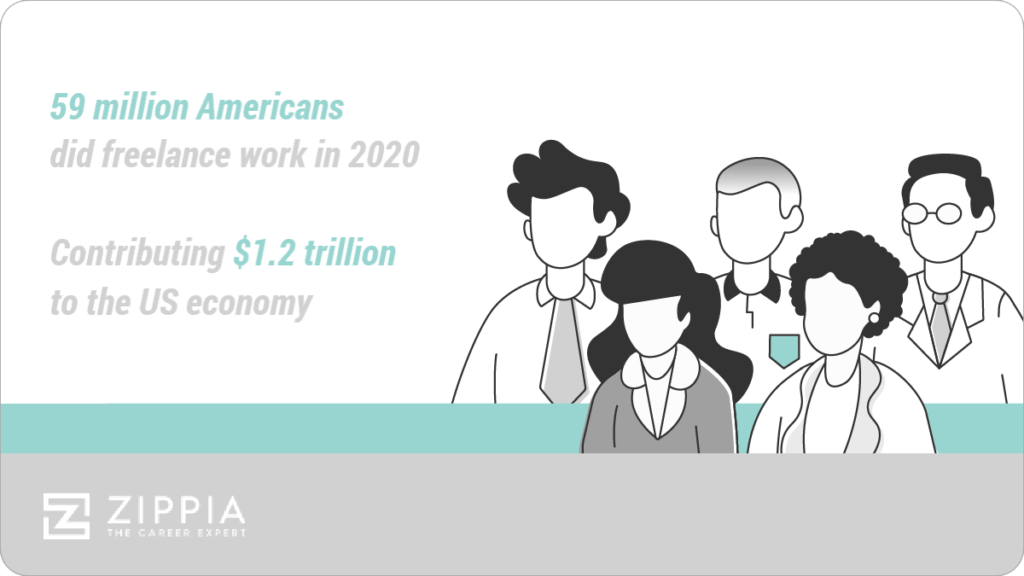

According to Upwork, around 53 million Americans are working as freelancers, yet Zippia’s numbers show that in 2020, 58 million Americans carried out freelancing work at some level, thus contributing $1.2 trillion to the U.S economy. This is a significant number of people and it’s only going to grow in the coming years as the independent economy continues to expand.

Out of these 53 million Americans, 21.1 million are independent contractors, corresponding to 40% of the independent workforce. However, why we are making the distinction between “freelancer” and “independent contractor”? Let’s go over some definitions!

We all have been an employee at some point in our lives. It could be that part-time job at the local ice cream shop during the summers or that first job after college graduation. But what makes an employee? An employee is somebody who works for a company in exchange for a salary, benefits, and sometimes equity. They are part of the company they work for.

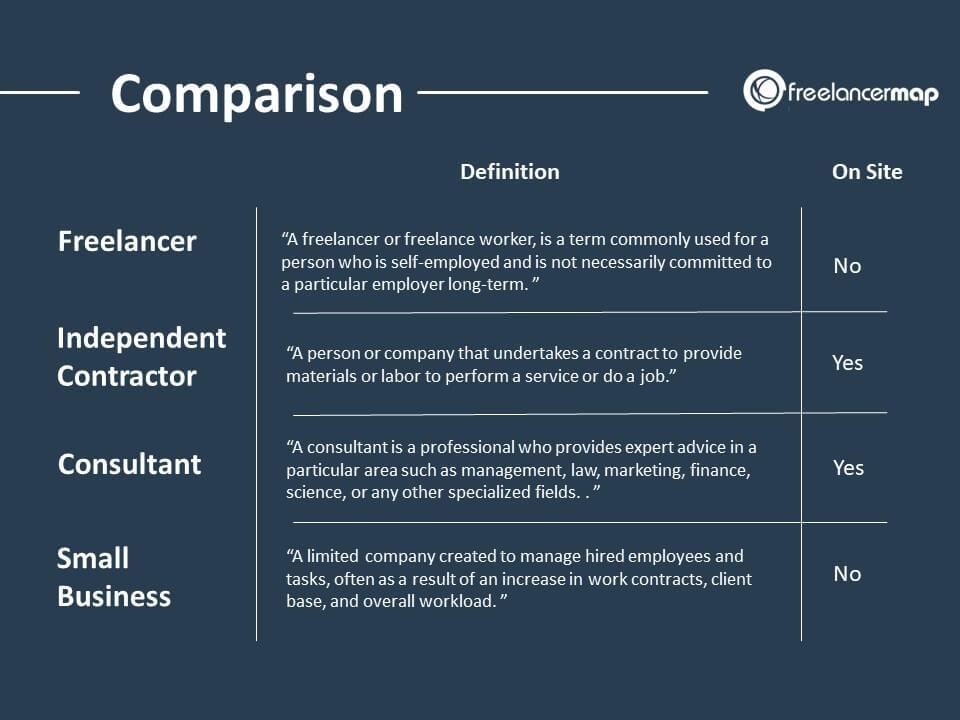

On the other hand, an independent contractor is usually defined as a person who provides services to another company or individual, under terms specified in a contract, and not as an employee of that company.

They are usually self-employed individuals who work on a project basis

Furthermore, a freelancer is someone who works for themselves, offering their services to multiple clients at a time. They are also their own boss and can set their own hours.

Below you have a nice, easy table to help you differentiate among the roles in today’s work environment.

Now that we have established the difference between an employee, independent contractor, and freelancer, let’s move on in-depth to the topic.

Advantages of Hiring Independent Contractors

You could be asking what you get from hiring an independent contractor. The benefits of hiring an independent contractor are vast. Independent contractors can provide a company with the ability to be more nimble and respond quickly to changes in the marketplace.

Cost Per Employee

Hiring an independent contractor can be more cost-effective than hiring a full-time employee. When you are only paying for the work that is completed, rather than the salary and benefits of a full-time employee, your business can save money.

Independent contractors are not subject to payroll taxes, unemployment insurance, workers’ compensation, and disability. Furthermore, they do not receive benefits that include pensions, sick days, health insurance, and vacation time. As a result, it is estimated employers can save up to 30% by hiring an independent contractor.

Flexibility

Independent contractors also offer businesses flexibility in terms of the hours they work and the days they work. Independent contractors are not bound by the traditional nine-to-five schedule, which means they can complete projects outside of normal business hours if necessary.

However, take into account that independent contractors are not entitled to overtime pay, even if they work more than 40 hours a week.

Skills and Expertise

Independent contractors also offer businesses access to skills and expertise that might not be available in-house. When you hire an independent contractor, you are tapping into their knowledge and experience, which can help your business grow.

Fewer Lawsuits

When you hire an independent contractor, you are not an employer, which means you are not liable for their actions. This can protect your business from lawsuits if the independent contractor is injured on the job or damages property.

It is Easier to End the Working Relationship

If an employer is not happy with the work of an independent contractor, they can simply stop working with them. There is no need to go through the hassle and expense of firing an employee.

Types of Independent Contractors

Now that we know the advantages of hiring an independent contractor, let’s take a look at the different types of independent contractors. There are four main types of independent contractors:

- Independent Contractor

- Freelancer

- Consultant

- Sole Proprietor

Independent Contractor

These professionals are usually hired to complete a specific project. Once the project is completed, the independent contractor is no longer working for the company. Independent contractors are typically paid by the hour or by the project.

Freelancer

A freelancer is similar to an independent contractor in that they are also hired to complete a specific project. However, freelancers usually work with multiple clients at one time. This means they might not be available to work on your project right away.

Consultants

Consultants are experts in their field and offer advice and guidance to businesses. They are usually hired on a short-term basis to help with a specific problem or goal.

Sole proprietors

Sole proprietorships are unique business structures where a single individual owns and operates the entire company. As the sole owner, they have complete control over all decisions and profit from the company’s success.

What do they all have in common? They are typically paid by the hour or by the project!

Now that you know the different types of independent contractors, let’s move on to how to pay them.

Get more out of your business

Get the best employee engagement content every week via mailing list

How to Pay Independent Contractors in Easy Steps: 1099 Payroll Guide

Paying an independent contractor is different than paying an employee. For example, when you pay an employee, you withhold taxes from their paycheck and send those taxes to the government. With an independent contractor, you do not withhold any taxes because they are responsible for paying their taxes.

So, if you’re an employer who hires independent contractors, you must know how to pay them correctly. After all, they are considered self-employed individuals and are not subject to traditional payroll taxes.

Worker Correct Classification

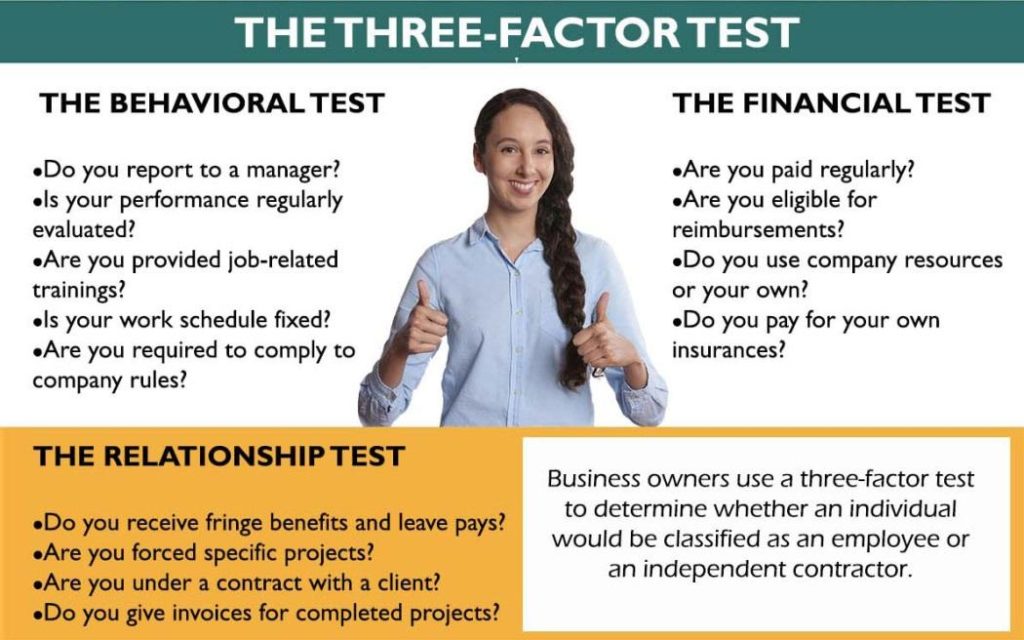

The first step is to determine whether or not your independent contractor is considered an employee or an independent contractor. This distinction is important because it will affect how you withhold taxes and other deductions from their pay.

The Internal Revenue Service (IRS) is the federal tax administration and enforcement agency of the United States government. As a thumb of rule, the IRS provides a three-factor test to correctly classify the worker.

This test considers three key components: behavioral control, financial control, and the type of relationship between the worker and the hiring entity.

- Behavioral control addresses whether the hiring entity has the right to control how, when, and where work is performed.

- Financial control looks at whether the worker has an investment in the business and opportunities for profit or loss.

- The type of relationship takes into account any written contracts or benefits provided by the company.

While this three-factor test can assist in classifying workers correctly, it is important to note that no one single factor determines classification and all factors must be considered together.

Correctly classifying workers as independent contractors or employees can help ensure compliance with tax laws and avoid potential penalties

It is also important to follow state and local laws, as they may have separate laws or requirements in place for determining independent contractor status.

Set a Rate and Payment Frequency

As a business owner, it is important to establish a clear rate and payment schedule with independent contractors. This helps ensure they are appropriately compensated for their work, while also assisting with budgeting and cash flow planning.

There are two main types of payments you can make to an independent contractor:

- Hourly Rate: You agree to pay the independent contractor an hourly rate for the work they complete.

- Flat Fee: You agree to pay the independent contractor a flat fee for the work they complete. The flat fee is typically based on the scope of work and the timeline for completion.

A signed contract or statement of work (SOW) should document the terms of payment, timelines for completion, and project deliverables

When setting the rate, consider factors such as market rates for comparable services, the contractor’s level of experience and expertise, and the scope of the project. It is also important to determine how often payments will be made – weekly or bi-weekly, for example – as well as clearly outline any invoice submission guidelines and payment terms.

By setting a rate and payment frequency upfront, independent contractors can rest assured they will be paid promptly for their work.

Collect a Completed W-9 Form

A W-9 form allows the independent contractor to identify themselves for tax reporting purposes and provide their taxpayer identification number (typically their social security number).

This information is used by the business owner to report payments made to the independent contractor on their tax forms. Without a completed W-9 form, payment to the independent contractor may be subject to backup withholding and potentially result in penalties for both the independent contractor and the business owner.

Keep in mind that a W-9 form must be collected from each independent contractor every year, as their information may have changed since the last time they were hired

Without this form on file, you may find yourself scrambling at the end of the year, scrambling to gather all the necessary information for tax season. So make it a habit to collect a completed W-9 form from each independent contractor before starting work with them.

Payment Calculation

As a business owner, it is important to accurately determine how much to pay independent contractors. To do so, start by determining the agreed-upon payment rate for the job in the SoW.

Make sure to take into account any additional expenses, such as materials or travel costs. Next, calculate the number of hours worked on the project and multiply it by the agreed-upon payment rate. If necessary, adjust this total based on any additional expenses previously mentioned.

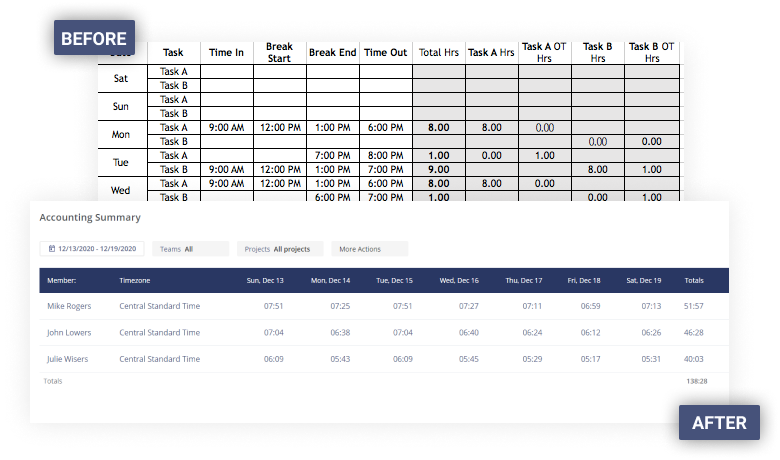

If you are having trouble calculating how many hours your independent contractor worked, Monitask’s Online Timesheets make it easy for independent contractors to track their time and get paid accurately and on time. Just look at the example below!

The intuitive system allows you to log your hours as you work and access them from anywhere with an internet connection. Monitask also offers integrations with popular payroll software making it easy to sync your timesheets with your financials.

Say goodbye to manual tracking and inaccurate billable hours with Monitask’s online timesheets!

The system streamlines the payment process for independent contractors, allowing you to focus on doing what you do best.

Remember to include any applicable taxes in their final payment calculation!

Process Payment

Once a project is completed and all parties are satisfied, it’s time to process payment for independent contractors. This can often be done through a payroll system, with payments typically sent via direct deposit or check.

- Payroll: Paying independent contractors through a payroll system is often the most efficient way to handle payments. This is because businesses can automate tax withholdings and other deductions.

- Direct Deposit: Direct deposit is the quickest and one of the most efficient ways to pay your contractors. It allows for easy payment processing and eliminates the need for paper checks.

- Check: However, sending a check is also a common method of payment for contractors. To do so, simply fill out a check with the contractor’s name, address, and Social Security Number.

Make sure to keep accurate records of all payments made to contractors, as this information will be needed for tax purposes

Independent contractors are required to report their income, so businesses need to have documentation of these payments on hand.

Prepare Your 1099 Tax Documents

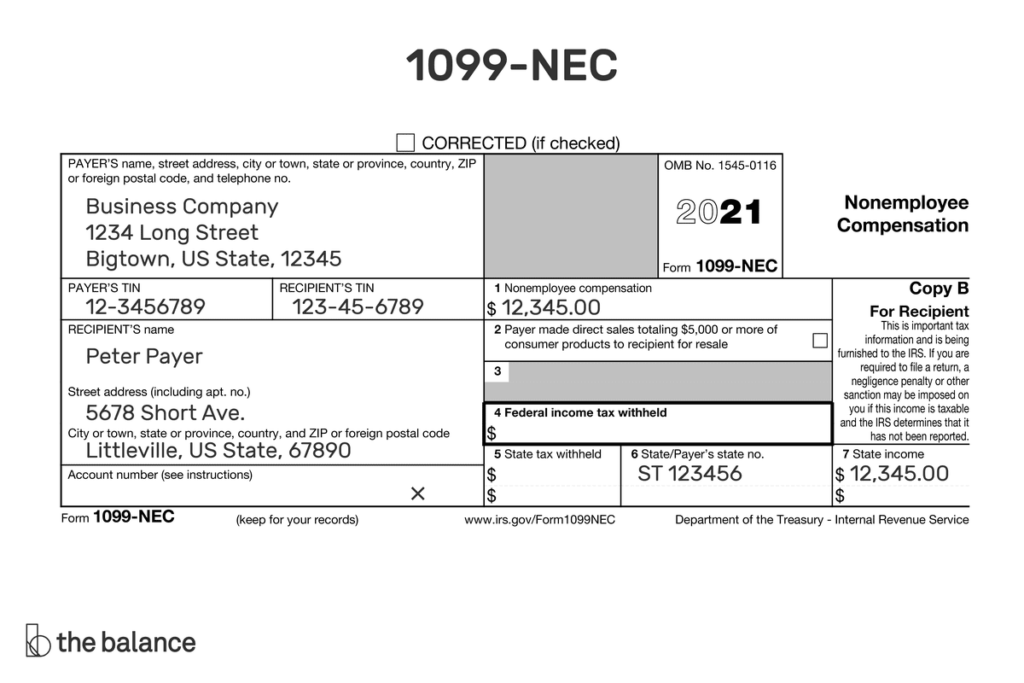

As a business owner, it is important to properly report independent contractor payments to the IRS. These payments need to be reported on a Form 1099-NEC if they exceed $600 and if the contractor’s business entity is not an S corp or C corp.

Remember, the IRS needs to know what wages are being paid out to assess and collect appropriate taxes

This form must be submitted to the IRS by January 31st, and it is also necessary to provide a copy of this form to the independent contractor. Consider incorporating a payroll platform that handles these 1099 filings for you and distributes them electronically to your independent contractors, as this can save valuable time and ensure accuracy in reporting.

Bottom Line

While it may seem like a lot of paperwork upfront, taking the time to correctly classify workers and collect the necessary forms can save you a significant amount of time and money down the road.

By following these simple steps, you can ensure that your payments are accurate and on time. Don’t forget to keep track of all the payments made to independent contractors throughout the year, as this information will be needed for tax purposes.

This article is intended to be a general resource and is not legal or tax advice. For more information on how to correctly classify workers, please contact the IRS or your local taxing authority.

-The Monitask Team